Liquid assets focus on speed and access. They show how quickly value can be turned into cash without loss.

A business can have positive working capital and still face cash pressure if most current assets are slow to convert. Common examples include unpaid invoices or inventory that takes time to sell.

In short:

- Working capital shows capacity

- Liquidity shows readiness

Why liquidity matters to a business

Liquidity influences how leaders make decisions when things get tight. It affects control, confidence, and the options available.

1. A buffer when costs appear:

Costs don’t always come on schedule. Equipment can break, customers may pay late, and expenses can rise without notice. When a business has liquidity, there’s time to deal with these issues without rushing into loans or quick cost cuts.

2. Staying reliable and credible:

Having cash on hand helps a business pay things like payroll, GST, and PAYG on time. It also helps maintain good relationships with suppliers and shows lenders that the business can meet its commitments.

3. It enables faster decisions

Liquidity enables action when timing matters. It allows businesses to:

- Secure early-payment discounts

- Lock in supply ahead of demand

- Fund pilots or market entry

- Respond to opportunities without delay

In practice, speed often depends less on strategy and more on access to cash.

4. It improves credit terms

Australian lenders and financial partners closely assess liquidity ratios.

Businesses with strong liquidity often see:

- Better loan terms

- Higher credit limits

- Lower perceived risk

Liquidity signals discipline and financial control.

5. It reduces forced decisions

Weak liquidity forces poor timing. Assets may need to be sold quickly. Investments may be cut early. Losses become permanent.

Liquid assets reduce pressure. They allow decisions to align with strategy rather than urgency.

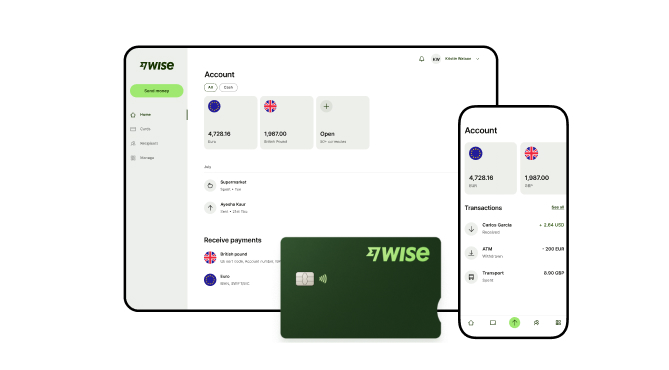

Wise Business: Improving access to global working capital

Managing liquidity becomes more complex when your business operates across borders, as slow bank transfers and currency conversion times can restrict access to your funds.

Wise Business helps solve this friction by allowing you to hold and manage multiple currencies in one place, so you can pay suppliers or receive revenue without unnecessary delays.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

- Free to register — Hold and convert between 40+ currencies. Send to 140+ countries

- Debit cards for you and your team, which you can use in 150+ countries

- Multi-user access for team members, with ways to control and manage permissions

- Pay up to 1,000 recipients at once with the Wise batch payments feature

- Integrate with your favourite cloud accounting solutions like Xero, QuickBooks, and more

- Get account details to receive in 8+ currencies for a one-time fee of 65 AUD

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

Earn a return with Wise Interest

Explore Wise Interest to earn potential returns on your AUD and USD balances*

Your money is invested in a fund of government-backed securities—without being locked away. So, you can still spend your balance as usual while it has the opportunity to grow.